Description

"400-year-old Geisha beauty secrets brought back to life"

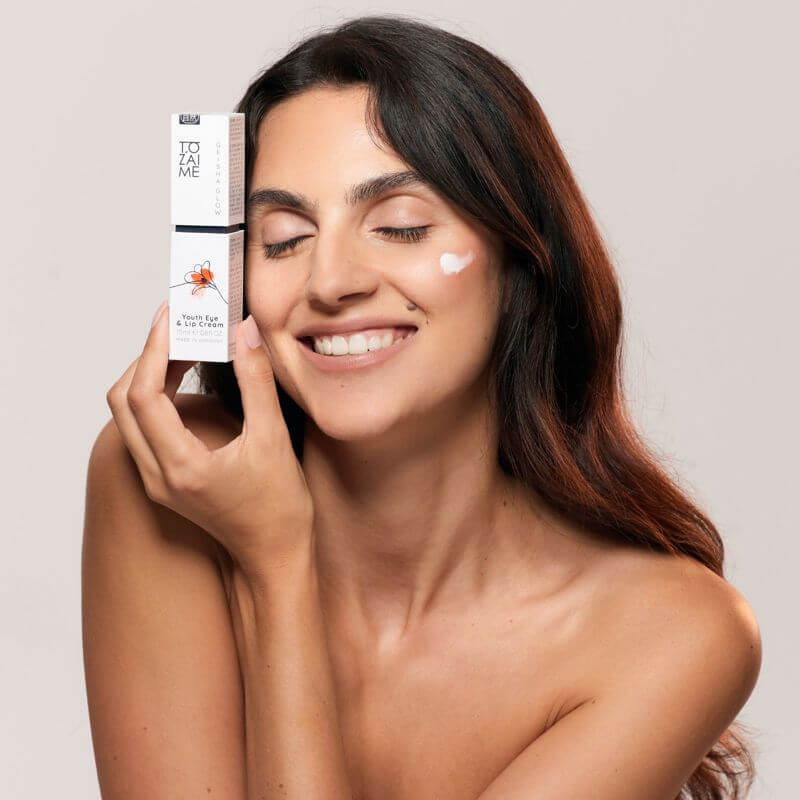

TOZAIME GmbH (www.tozaime.com) is a German natural cosmetics company based in Munich that specialises in the development and distribution of skin care products based on traditional Japanese "400 year-old Geisha beauty secrets, brought back to life"

TOZAIME GmbH is a German natural cosmetics company based in Munich that specialises in the development and distribution of skin care products based on traditional Japanese recipes. The brand combines centuries-old beauty secrets of geishas with modern plant research to offer high-quality, sustainable and effective cosmetic solutions.

🧨 Key Highlights

• Brand-driven D2C skincare business with a strong foundation in Japanese-inspired beauty rituals and minimalist (skinimalism) routines.

• Backed by science & tradition: Formulations combine modern phytoscience with ancient Japanese practices (fermentation, Tsubaki oil, Wakame seaweed).

• Premium positioning: Average order value of €80–100; ~5-month repurchase cycle; cult-like hero product with near-perfect ratings (e.g. Geisha Glow Youth Cream).

• Fully developed brand world: Distinctive aesthetic (Japanese minimalism), highly engaging visual assets (AI-enhanced), and proven brand language.

• Sustainable innovation leader: Among the first in EU to offer luxury skincare in sugarcane-based airless paper bottles.

• Inventory in place: Existing inventory worth ~€370k (retail value) enables instant monetization or scaling without immediate production needs.

• Massive reach potential: Currently under-leveraged marketing channels (email, influencer, paid social); organic content shows proven resonance.

• Lean operation: Can be run remotely with minimal fixed cost structure and no full-time team required.

🛠 Operations

• Business model: Direct-to-consumer ecommerce (Shopify), with occasional B2B pilots (e.g., past partnership with Douglas). Revenue from sales of skincare sets, creams, serums, and natural sponges.

• Current effort: Operated by 1 founder part-time (~3h/week). Fulfillment and logistics are outsourced. No full-time staff.

• Production: Made in Germany via contract manufacturing. All formulations and supplier relationships are transferable and secured.

• Maintenance: Shopify store, Klaviyo email flows, and minimal customer support (~2-3 tickets/week).

• Transition: Full SOP documentation and onboarding support can be provided.

💖 Customers

• Audience: Environmentally conscious women aged 35–60, interested in minimalist luxury and traditional beauty rituals. Strong resonance with Japan lovers and wellness enthusiasts.

• Geography: Primarily Germany, with some sales in Austria, Switzerland and other EU countries. Easy to expand globally.

• Customer acquisition: Organic content (Instagram), Meta ads, email list (~5,500 subs with 15% CTR), and direct engagement.

• Customer loyalty: Very high retention among repeat buyers. LTV significantly increases after 2nd purchase.

• Community: Brand has emotional resonance – recent posts using storytelling & philosophy perform well.

🚀 Opportunities for a New Owner

• Expand Channels: Leverage TikTok, Pinterest, influencer seeding, and Amazon for broader reach.

• Email & Retargeting: High-potential email list and Meta pixel already in place, barely utilized.

• Spa & boutique partnerships: Brand aesthetics and product quality ideal for high-end collaborations.

• Expand SKUs: Launch adjacent SKUs or limited edition seasonal lines using existing formulations + Japanese narratives.

• Internationalization: Build on brand's Japan-inspired identity to expand into Asia and the U.S.

• Leverage Inventory: Unlock €300K+ in retail value from current inventory with a strong Q4 push.

💰 Financials

• 2024 revenue: ~€65,000 — achieved with lean operations and minimal spend via Meta ads and email marketing only.

• The company entered hibernation in Q3 2024 following the founders' split. Since then, operations were paused, yet the business has continued to generate passive revenue of €500–€1,000/month from repeat buyers — a testament to brand loyalty and product efficacy.

• Cost structure is light: fixed overheads are negligible; no salaried staff; all logistics and fulfillment are outsourced.

• Gross margins ~80%, supported by D2C pricing and premium positioning. Packaging and COGS optimized through German contract manufacturing.

🚀 What This Means for a Buyer

• A new owner with marketing or brand-building expertise can quickly revive and scale with existing inventory (~€370k retail value) and audience assets (5.5k email list, engaged followers, pixel data).

• The business is primed for a Q4 relaunch or rebrand with almost no capital expenditure required.

• 6-figure upside possible within months through ad scaling, influencer collaborations, or SPA/boutique partnerships.

recipes. The brand combines centuries-old beauty secrets of geishas with modern plant research to offer high-quality, sustainable and effective cosmetic solutions.

In 2024, the company generated ~€70k in revenue. The founder team split up and is now selling the business. The remaining inventory has a sales value of €370k.